So, how much does it really cost to insure your electric bike? For most riders, a solid policy will land somewhere between $150 to $300 per year. That’s a pretty small price to pay for the peace of mind that comes with protecting your ride from theft and damage.

The Real Cost of Insuring Your Electric Bike

An electric bike isn't just a bike; it’s a real investment. It’s your daily commuter, your weekend trail machine, or your ticket to getting around town without a car. It makes sense to protect it.

While no one loves another bill, the cost of e-bike insurance is usually much more affordable than people think, and it can save you from a massive financial headache down the road.

Think about it this way: you wouldn’t drive a new car off the lot without insurance. With many e-bikes easily costing between $2,000 and $5,000, leaving one uninsured is a huge gamble. You’re not just risking the bike itself—you’re also exposed to liability if an accident happens. The premium you pay isn't just a random number; it's a carefully calculated rate based on a few key things we'll get into.

Why Insurance Is Becoming Essential

The truth is, dedicated e-bike insurance is becoming less of a "nice-to-have" and more of a necessity. As these bikes get more popular and more valuable, they’ve become a prime target for thieves. In some cities, e-bike theft has shot up by over 50% in just the last few years.

This trend is exactly why the insurance market for e-bikes is booming. In fact, it's expected to become a $1.0 billion industry by 2030, which shows just how many riders are seeing the value in getting covered. You can learn more about the growing e-bike insurance market and its driving factors to see where things are headed.

For the average rider in North America, a standard policy will cover the big stuff: replacement if it gets stolen and liability coverage up to $100,000. This protects you from the most common (and expensive) things that can go wrong.

Factors That Shape Your Premium

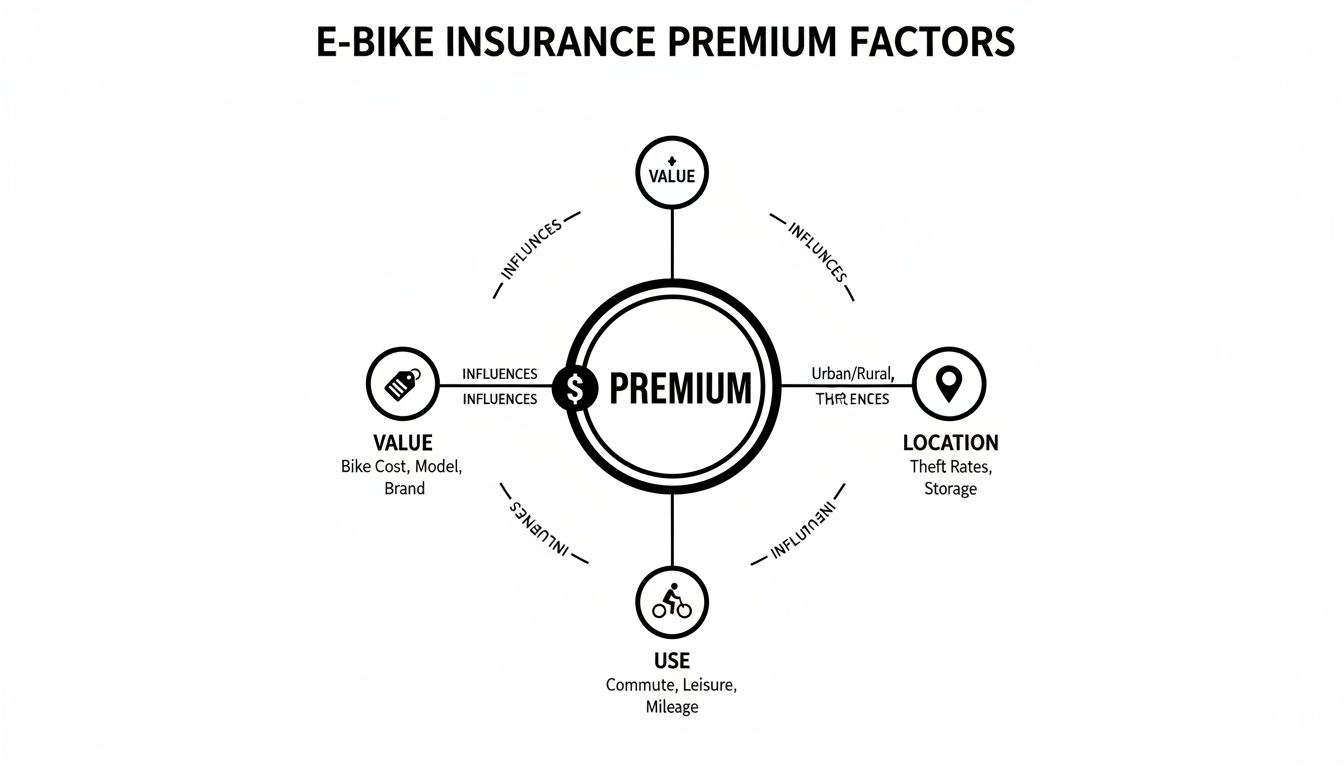

The final price tag on your e-bike insurance is tailored to you and your bike. Insurers look at a handful of variables to figure out their risk, which in turn sets your annual premium. Once you understand what they're looking at, you can see how your own situation affects the cost—and maybe even find ways to lower it.

Let's break down the main factors that go into your insurance quote.

Here’s a quick summary of what insurance companies look at when they're calculating your premium.

Key Factors That Determine Your E-Bike Insurance Premium

| Factor | Impact on Cost | Example |

|---|---|---|

| Bike Value & Type | High | A $4,500 high-performance electric dirt bike will have a higher premium than a $1,500 commuter e-bike. |

| Your Location | High | Premiums are generally higher in dense urban areas with greater theft and accident risks compared to rural settings. |

| Rider Age & History | Medium | A mature rider with a clean record may receive a lower rate than a younger, less experienced rider. |

| Primary Usage | Medium | Using your e-bike for daily commuting in traffic poses more risk than casual weekend rides on park trails. |

| Security Measures | Medium | Using a certified U-lock and storing your bike in a locked garage can lead to discounts on your policy. |

Key Takeaway: At the end of the day, your insurance premium is all about risk. A pricey e-bike that you ride daily in a big city is naturally going to cost more to insure than a cheaper model you only take out on suburban trails once in a while.

What Actually Drives Your Insurance Premium

So, what goes into the price tag for e-bike insurance? Think of it like car insurance. An insurer’s job is to figure out the odds of you filing a claim. The higher they think that risk is, the more you'll pay in premiums. It’s never just one thing; it's a whole mix of factors that creates a complete picture of your bike, your habits, and where you ride.

A high-powered electric dirt bike hitting rough trails is a totally different beast than a chill Class 1 commuter e-bike cruising down a paved bike path. Insurers dig into these specifics to land on a price that matches the real-world risk of theft, damage, or an accident.

Let's pull back the curtain and see exactly what they're looking at.

As you can see, it really boils down to a balance between what your bike is worth, where you'll be riding it, and what you're using it for.

The Value and Type of Your E-Bike

This one's the easiest to wrap your head around. The more your electric bike costs, the more it costs to insure. Simple as that. The insurance company has to consider how much they’d be on the hook for if your bike got stolen or wrecked beyond repair.

- High-Value Bikes: A premium, $4,000 electric dirt bike is naturally going to have a higher insurance cost than a $1,500 entry-level commuter. The potential payout is just a lot bigger.

- E-Bike Class: The class of your bike (1, 2, or 3) also plays a part. A Class 3 e-bike that can hit 28 mph is seen as a greater risk for accidents than a Class 1 pedal-assist that caps out at 20 mph. That extra speed often bumps up the premium a bit.

At the end of the day, a more expensive and more powerful bike simply costs more to protect.

Your Location and Riding Environment

Where you live, ride, and store your bike is a huge piece of the puzzle. Giving an insurer your zip code is like giving them a snapshot of local risks, from theft statistics to traffic patterns.

Premiums in a crowded city center, for instance, are almost always higher than in a sleepy suburb. Cities just have more bike theft and a much higher chance of a run-in with traffic. Storing your e-bike in a locked garage versus chaining it to a pole on a busy street also factors heavily into their math.

Key Insight: Insurance companies are all about data. If your neighborhood has a high number of reported bike thefts, your premium will reflect that statistical risk.

Local and state laws can also have an impact. Regulations vary wildly from one place to the next, so it's a good idea to know the rules of the road. You can learn more by checking out our guide on electric bike laws by state.

How You Use Your E-Bike

What does your typical ride look like? An insurer will want to know how often you ride and what you're doing when you're out there.

- Commuting vs. Recreation: Someone riding 10 miles through city traffic every day for work is exposed to way more risk than a weekend warrior who sticks to quiet park trails. More time on the road, especially in busy areas, means more chances for things to go wrong.

- Off-Road Riding: If you're shredding trails on an electric dirt bike, your risk profile looks completely different. Off-roading opens the door to unique types of damage, like a cracked frame from a hard landing or motor problems from impacts. Some basic policies won't even cover off-road use, meaning you'd need specialized (and potentially more expensive) coverage.

Your Personal Rider Profile

Finally, the insurance company looks at you. Just like with your car, personal details like your age and any past claims you've made can nudge your rate up or down.

A mature, experienced rider with a clean record is a much safer bet for an insurer and will often get a better price. On the flip side, a younger rider with less experience might see a slightly higher premium. You can sometimes even score a discount by completing a certified bike safety course—it's a clear signal to insurers that you're a responsible rider.

Choosing the Right E-Bike Insurance Coverage

Trying to understand an insurance policy can feel like you're reading a foreign language. Words like "liability," "comprehensive," and "deductible" get thrown around, and it's tempting to just pick the cheapest plan and hope for the best. But that’s a huge gamble.

Building the right coverage is like gearing up for a big ride; what you need depends entirely on where you're going and what you're doing. A weekend rider who sticks to quiet park trails has totally different needs than a daily commuter weaving through downtown traffic. The goal isn't to buy every possible protection. It's about creating a safety net that fits your life and protects your bike, without paying for stuff you'll never use.

Let's break down the main types of coverage you'll see. Think of this as your guide to building a policy that lets you ride with total peace of mind.

The Three Pillars of E-Bike Insurance

Most solid e-bike insurance policies are built on three core protections. You can think of these as the absolute essentials—the frame, wheels, and handlebars of your coverage.

- Liability Coverage: This is your financial bodyguard if you're ever at fault in an accident. If you accidentally roll into a pedestrian or scratch a parked car, liability coverage helps pay for their medical bills or repair costs. Without it, you’re on the hook personally, and that could mean thousands of dollars out of your own pocket.

- Collision Coverage: This one’s all about protecting your own bike if you get into an accident, no matter who’s at fault. Whether you hit a pothole and crash, clip a curb, or have a run-in with another cyclist, this coverage pays to get your bike fixed or replaced.

- Comprehensive Coverage: Think of this as protection from everything else. Comprehensive steps in to cover theft, vandalism, fire, or other damage that isn't from a collision. With e-bike theft becoming more common, this is often the number one reason riders get a dedicated policy.

Here’s the bottom line: Liability protects other people from your mistakes, while collision and comprehensive protect your bike from accidents and theft. A great policy has all three working together.

Don't forget that local laws play a big role here, too. To pick the right liability limits, you need to know how your state classifies your e-bike and what insurance might be required. For example, looking at the Pennsylvania e-bike laws gives you a good idea of how specific these rules can be.

Valuable Add-Ons for Complete Protection

Once you have the core three covered, you can customize your policy with some really useful add-ons. These are the extras that can turn a major headache into a minor inconvenience.

- Roadside Assistance: Ever had your battery die miles from home? This add-on is a lifesaver. It typically covers things like a tow for you and your bike to the nearest shop.

- Medical Payments: This helps pay for your own medical bills after an accident, regardless of who was at fault. It's great for covering your health insurance deductible or co-pays so you aren't stuck with a surprise bill.

- Accessory Coverage: Did you trick out your bike with a premium GPS, a powerful light kit, or custom cargo racks? A standard policy might not cover those upgrades. Accessory coverage makes sure your expensive gear is protected right along with the bike.

- Replacement Cost Value (RCV): This one is a big deal. RCV ensures that if your bike is stolen or totaled, you get enough money to buy a brand-new, similar model. Without it, the insurance company might only give you the bike's depreciated value, which is often way less than you need for a replacement.

E-Bike Insurance Coverage Compared

Okay, let's put all the pieces together. This side-by-side look at common e-bike insurance coverages will help you decide what level of protection you really need.

| Coverage Type | What It Protects | Who Needs It Most |

|---|---|---|

| Liability | Bodily injury and property damage you cause to others. | Everyone. This is non-negotiable protection for all riders. |

| Collision | Damage to your e-bike from an accident. | Daily commuters and anyone riding in traffic or on challenging terrain. |

| Comprehensive | Theft, vandalism, and non-collision damage. | Riders in urban areas or anyone who parks their bike in public spaces. |

| Medical Payments | Your own medical expenses after an accident. | Riders with high-deductible health plans or those who want extra financial safety. |

| Accessory Coverage | Your custom parts and upgrades. | Anyone who has invested in significant modifications or expensive gear. |

Matching your riding style to the right coverage is the key. A city commuter definitely needs comprehensive for theft, while an off-road enthusiast might prioritize collision and medical payments. It's all about what makes you feel secure on and off the bike.

How Real Riders Budget for Insurance

Theory is great, but let's be honest—seeing how insurance costs play out in the real world is what really matters. When you can connect the numbers to riders just like you, the abstract idea of a premium becomes much more tangible.

Let’s walk through three common scenarios to see how different bikes, habits, and locations actually shape the final price you'll pay.

Think of these stories as a solid baseline. They'll help you get a feel for what to expect and budget for this essential protection before you even hit the road.

Scenario 1: The City Commuter

First up, meet Alex. He lives in a bustling downtown apartment and relies on his e-bike to weave through dense city traffic every day. His commute is about eight miles round-trip, and he’s constantly locking up his bike outside his office or local shops.

- Rider Profile: Daily commuter in a major metropolitan area.

- Bike Details: A zippy $2,800 Class 3 commuter e-bike, perfect for keeping pace with traffic.

- Primary Risks: A high risk of theft from being parked in public so often, plus an increased chance of an accident in bumper-to-bumper traffic.

- Security: He’s smart about it, using a heavy-duty chain lock and a GPS tracker.

- Chosen Coverage: Alex goes for a comprehensive policy. He wants robust theft protection, high liability limits ($100,000), collision coverage, and roadside assistance. Because his bike is his main ride, he opts for a lower $250 deductible.

Estimated Annual Premium: $280 - $350

Alex's premium leans higher because his urban environment and daily use statistically bump up his risk. The bike's value and his choice of extensive coverage with a low deductible also play a big part in the final cost.

Scenario 2: The Off-Road Enthusiast

Now, let's look at Maria. She's an avid trail rider who spends her weekends shredding singletrack and exploring rugged forest roads. She hauls her powerful electric dirt bike to trailheads, riding far from paved streets and city risks.

- Rider Profile: A weekend warrior who lives for off-road adventures in rural and mountainous areas.

- Bike Details: A $4,500 high-performance electric dirt bike built to handle tough terrain.

- Primary Risks: Damage is the main concern here—crashes, falls, and impacts with trail obstacles are all part of the sport. Theft is a much lower risk since the bike lives in a locked garage and is rarely left unattended.

- Security: Stored securely at home; almost never parked in public.

- Chosen Coverage: Maria’s priority is protecting her expensive investment from trail damage. She chooses a policy with strong collision coverage, medical payments for potential injuries, and replacement cost value. To keep her premium manageable, she opts for a higher $750 deductible, feeling confident about her low theft risk.

Estimated Annual Premium: $320 - $400

Even with a lower theft risk, Maria's premium is the highest of the three. Why? It's driven almost entirely by the bike's high value and the very real possibility of expensive damage that comes with aggressive off-road riding.

Scenario 3: The Suburban Weekender

Finally, there’s David. He's a retiree who enjoys leisurely weekend rides on paved bike paths through his quiet suburban neighborhood. His e-bike is for fun and the occasional errand, usually clocking less than 20 miles a week.

- Rider Profile: Casual, recreational rider in a low-risk suburban area.

- Bike Details: A comfortable $1,800 Class 2 cruiser e-bike.

- Primary Risks: Pretty minimal. Theft rates in his area are low, and there isn't much traffic on his routes.

- Security: The bike is always stored in his locked garage.

- Chosen Coverage: David just wants basic peace of mind. He picks a policy with standard liability and comprehensive coverage for theft, choosing a moderate $500 deductible. His bike isn't a massive investment, so this level of protection feels just right. Deciding if the purchase fits your budget is a key first step, and you can explore more by reading our guide on whether electric bikes are worth it.

Estimated Annual Premium: $150 - $220

David's low-risk profile—a less expensive bike, safe storage, and casual use in a quiet area—adds up to a very affordable premium. His situation is the perfect example of how a safer environment directly leads to lower insurance costs.

Actionable Strategies to Lower Your Premium

Knowing what shapes your insurance rate is one thing, but actively lowering your electric bike insurance cost? That's where you take back control. You don't have to just accept the first number that comes your way.

With a few smart moves, you can knock down that premium while keeping the solid protection you need for your ride. Think of it like buying a car—a little prep work and knowing what to ask for can save you a surprising amount of cash. We'll walk through everything from getting your ducks in a row to the proven tricks that insurance companies actually reward.

Prepare and Shop Around

Before you even think about getting quotes, get organized. Having all your info ready not only makes the process a thousand times smoother but also ensures the estimates you get are actually accurate.

Here’s what you’ll want to have on hand:

- Bike Information: Your e-bike’s make, model, year, and serial number.

- Purchase Details: The original receipt or some other proof of what you paid for it.

- Personal Information: Your address, birthdate, and any riding history they ask about.

Once you’re ready, don't stop at the first quote. The golden rule is to compare at least three different options. Check out the companies that specialize in e-bikes, but also give your current home or auto insurance provider a call. They might offer a sweet deal for adding it to your existing plan.

Boost Your Bike Security

Insurance companies are all about managing risk. If you make your bike a tougher target for thieves, you become less of a risk in their eyes, and that can translate directly into a lower premium. Seriously, investing in good security is one of the best ways to earn a discount.

Think about making these upgrades:

- High-Quality Locks: A Sold Secure Diamond or Gold-rated U-lock is your best friend. Many insurers specifically offer discounts if you use a certified lock.

- GPS Trackers: Slapping a hidden GPS tracker on your bike dramatically increases the odds of getting it back if it's stolen. Insurers love that and often reward you for it.

- Secure Storage: When getting a quote, make it clear that you store your e-bike inside your home or in a locked garage. This is a huge checkmark in the "low risk" column.

You can often find a 5% to 15% discount just for proving you use top-notch anti-theft gear. The investment pays for itself pretty quickly, both in savings and peace of mind.

Adjust Your Coverage and Deductible

Another powerful lever you can pull is fine-tuning your actual policy. The goal is to find that perfect balance between having enough coverage and not overpaying. The easiest dial to turn here is your deductible.

A deductible is simply the amount you agree to pay out-of-pocket on a claim before the insurance company steps in. Let's say your $3,000 bike gets stolen and you have a $500 deductible. You'd cover the first $500, and your insurer would pay out the remaining $2,500.

- Higher Deductible, Lower Premium: If you agree to a higher deductible, say $750 instead of $250, you’re taking on more of the initial risk. Your insurer will thank you with a lower annual premium.

- Lower Deductible, Higher Premium: A lower deductible means less risk for you and more for the insurer, so your premium goes up.

Ultimately, this comes down to your personal finances. If you have an emergency fund and could comfortably handle a higher out-of-pocket cost, raising your deductible is a fantastic way to save on your yearly bill. For more general tips that also apply here, check out this great guide on how to reduce insurance premiums.

Take a Safety Course and Bundle Policies

Finally, show them you're a safe bet. Completing a certified bike safety course proves you’re a responsible rider, which can often shave a little extra off your premium.

And don't forget about bundling! This is often the easiest win. If you already have homeowners, renters, or auto insurance, ask about adding your e-bike policy. Insurers want to keep all your business in one place and will often offer a nice discount—sometimes up to 10%—just for bundling.

Wrapping It Up: Protecting Your Ride the Smart Way

Figuring out electric bike insurance doesn't have to be a headache. At the end of the day, it's all about protecting a serious piece of equipment—your daily commuter, your weekend trail warrior, and your ticket to freedom. You already made the big decision to invest in a quality e-bike; making sure it's covered against theft, damage, or liability is the next logical move.

As we've covered, the price you pay for a policy comes down to a few simple things: your bike's value, where you live and ride, and what you use it for. A daily city commuter has a totally different risk profile than an off-road adventurer, and that's reflected in the insurance. The trick is to see these factors not as roadblocks, but as dials you can turn to find the right coverage.

Key Takeaways for Smart Riders

- Your Policy Should Match Your Ride: Don't buy a one-size-fits-all policy. If you're a city rider, strong theft protection is a must. If you hit the trails hard, you'll probably want to focus more on collision coverage.

- Good Security Saves You Money: Spending a little extra on a top-tier lock and finding a secure spot to store your bike isn't just for your own peace of mind. It directly translates into lower insurance premiums.

- Always Shop Around: The first quote you get is rarely the best one. Take the time to compare prices from specialty e-bike insurers and even check with your current home or renter's insurance provider to find the best deal.

Think of insurance as the final piece of the e-bike ownership puzzle. It turns your fun new ride into a fully protected asset, giving you the confidence to take on any adventure. The very first step in getting a quote is having your bike's info ready. If you need help, our guide on how to find and record your bike's serial number will walk you through it.

The smartest investment you can make after buying your e-bike is insuring it. For a small annual cost, you gain the confidence to ride anywhere, knowing you're covered for whatever the road throws your way.

Now that you've got the inside scoop, you're ready to start gathering quotes and lock in the perfect policy. Go get your ride secured, protect that investment, and enjoy the journey.

E-Bike Insurance FAQs

Insurance can feel like a maze of fine print and what-ifs. Let's clear the air and tackle some of the most common questions we hear from riders about protecting their e-bikes. Knowing the answers will help you feel confident that you're covered, no matter where your ride takes you.

Does My E-Bike Warranty Cover Theft or Accidents?

This is a huge point of confusion for a lot of new owners, so let's set the record straight: no, it doesn't.

Think of your warranty, like the one we provide at eBike Gang, as a promise about the quality of the bike itself. It's there to protect you if a part fails due to a manufacturing defect, like a faulty motor or a battery that won't hold a charge.

A warranty won't help you if:

- Your bike gets stolen from the rack outside your office.

- You hit a nasty pothole and damage the frame or a wheel.

- Someone decides to vandalize your bike while it's locked up.

- You're involved in an accident that injures another person.

That’s where dedicated e-bike insurance comes in. It's designed specifically for these real-world scenarios that fall completely outside the scope of a manufacturer's warranty.

Is My Electric Dirt Bike Covered for Off-Road Use?

If you live for the trails, this is a must-ask question. The answer really boils down to the specific policy you choose. Many basic e-bike insurance plans are built for city commuters and will explicitly exclude coverage for off-road riding, racing, or anything that happens on an unpaved trail.

Be totally upfront with your insurance provider about how you ride. If you plan on taking your VETRA BLAZER through its paces on dirt tracks, you need to make sure your policy specifically covers that. If it doesn't, you could be in for a nasty surprise when you try to file a claim.

Always ask about off-road exclusions and see if they offer an add-on or a specialized plan for trail riding.

Are My Expensive Accessories and Upgrades Insured?

Out of the box, a basic policy probably won't cover them fully. If you've spent good money adding a premium GPS unit, powerful custom lights, or a heavy-duty cargo system, you'll want to look into accessory coverage.

Standard policies often have surprisingly low limits for non-stock parts—sometimes just a few hundred dollars. To make sure your investment in gear is protected, you’ll need to add that extra coverage. It typically doesn't add much to your premium and gives you peace of mind that everything on your bike is covered, not just the bike itself.

Will My Homeowners Insurance Cover My E-Bike?

Sometimes, but it’s rarely a good solution. A standard homeowners or renters policy might give you a sliver of coverage, but it's usually riddled with limitations that make it inadequate for a modern e-bike.

Here are the typical gotchas:

- Low Payout Caps: Most policies have a low limit for certain categories, often capping payouts for things like bikes at around $1,500. That’s not going to cut it for most quality e-bikes.

- "At-Home" Only Coverage: The policy usually only covers theft from your property. If your bike is stolen from work, a cafe, or a trailhead, you're likely out of luck.

- Zero Liability Protection: This is the big one. Homeowners insurance almost never covers you if you cause an accident and injure someone while out riding.

A dedicated e-bike policy is built to provide comprehensive protection that actually follows you and your bike on the road or trail.

Ready to protect your ride? The eBike Gang team is here to help you get the most out of every adventure with our powerful and reliable electric bikes. Explore our collection today and find the perfect e-bike for your journey.